It is possible to lead a sure path to have a stable income each month by investing wisely. If youd like to generate $3,000 monthly, then a few smart investment strategies can come in handy. The big key here: invest in a diversified way, or take the word portfolio out of your life. This means to spread your money across various types of investments. Managing risk better and increasing your chances for returns is what this approach can do for you. No matter what you are looking for like stocks, real estate or mutual funds, there are pros and cons for each. You should evaluate your risk tolerance, investment timeline, and financial objectives. The more you learn about the various investing avenues, the better prepared you can be to make your decisions. If you follow a well thought out plan, you can position yourself to have a steady flow of income and a financially safe future.

Understanding Investment Basics

Before diving into specific strategies, it is important to understand some basic concepts of investing. This will help you make informed decisions and avoid common pitfalls.

1. Risk vs Return:

It is always the case that higher returns attract higher risks. One has to be aware of your risk profile in corresponding to investment plans before making any investment decision. Normally, young people make some higher risk investments due to the longer expected time to live from their invested money. On the other hand, those people who are near the retirement age may prefer investing in those security that will give them a guaranteed income.

2. Diversification:

Several factors influencing the stream for an investor therefore require that appropriate diversification measures be made to reduce extreme risks where possible. An investment in equities, debentures, and properties, for instance, decreases the effects of losing a certain type of investment.

3. Compounding:

The magic of compounding is when your investments earn returns that are reinvested back into the account for further growth. Over time, this can greatly increase your investment's value and generate significant returns.

Determining Initial Capital

When starting your investment journey, it is important to determine how much initial capital you have available. This will help you decide on the types of investments you can make and the potential returns.

1. Savings:

Start by assessing how much savings you have available that you can comfortably invest without affecting your daily expenses. This could include any emergency funds or a portion of your disposable income each month.

2. Assets:

Take stock of any assets such as property or valuables that you could potentially liquidate for investment purposes. However, be cautious about selling essential assets that may impact your financial stability in the long run.

Investment Strategies to Generate $3,000 Monthly

Now that you have a better understanding of investment basics and your initial capital, here are some strategies to help you generate $3,000 monthly.

1. Dividend Stocks:

Investing in dividend stocks can provide a steady stream of passive income. These are companies that distribute a portion of their profits to shareholders on a regular basis. By investing in well-established companies with a history of consistent dividends, you can earn regular income while also benefiting from potential stock price appreciation.

2. Real Estate Investment Trusts (REITs):

REITs, or Real Estate Investment Trusts, are firms that own and manage income-producing properties like apartments, office buildings, and shopping centers. Investing in REITs allows you to share in the rental income generated by these assets.

3. Peer-to-Peer Lending:

Peer-to-peer lending involves lending money to individuals or businesses through online platforms in exchange for interest payments. This can be a high-risk, high-reward investment option, so it is important to carefully research and select reputable platforms.

4. Rental Properties:

Investing in rental properties can provide a steady stream of passive income. However, this requires careful analysis of rental markets, property management, and financial planning for potential vacancies and maintenance costs.

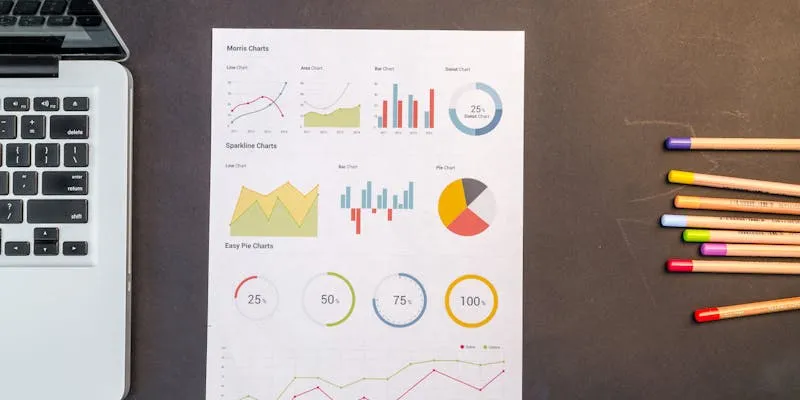

Creating a Diversified Portfolio

To maximize returns and minimize risk, it is important to create a well-diversified investment portfolio. This means investing in a variety of assets such as stocks, bonds, real estate, and alternative investments like commodities or cryptocurrencies.

1. Asset Allocation:

Asset allocation refers to the distribution of your investments across different asset classes based on your risk tolerance and financial goals. A balanced approach would include a mix of high-risk, high-reward investments along with lower-risk options for stability.

2. Regular Portfolio Review:

It is important to regularly review and adjust your investment portfolio as market conditions and your financial goals may change over time. This will help you stay on track towards generating $3,000 monthly and securing your financial future.

3. Seek Professional Advice:

Seeking advice from a financial advisor or investment professional can be helpful in creating a well-diversified and tailored portfolio based on your individual needs and goals.

Monitoring and Adapting Your Strategy

The investment landscape is constantly changing, and it is important to monitor and adapt your strategy accordingly. Keep up with market trends, stay informed about economic conditions, and reassess your portfolio regularly to ensure that you are on track towards generating $3,000 monthly.

- Take advantage of market dips to buy quality investments at a lower price.

- Keep an eye on interest rates and make adjustments accordingly in your portfolio.

- Stay updated on tax laws and take advantage of any investment-related deductions or credits.

Conclusion

Generating a steady income of $3,000 monthly from investments is a realistic goal with careful planning and execution. Understanding the basics of investing, managing your initial capital effectively, and selecting the right mix of strategies such as dividend stocks, REITs, peer-to-peer lending, and rental properties are key steps towards achieving this objective. By maintaining a diversified portfolio and periodically reviewing your investments, you can navigate the complexities of the financial world with confidence. Remember, seeking professional advice when needed and staying informed about market trends will further assist you in adapting your strategy for long-term success. With consistency and diligence, you can build a robust financial foundation and work towards securing a prosperous future.